Question: During Heaton Companys first two years of operations, the company reported absorption costing net operating income as follows: The companys $18 unit product cost is

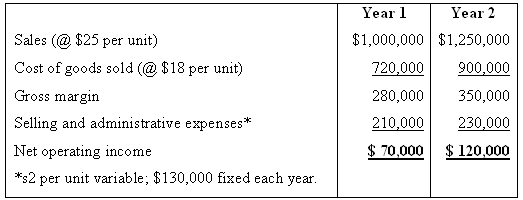

During Heaton Company’s first two years of operations, the company reported absorption costing net operating income as follows:

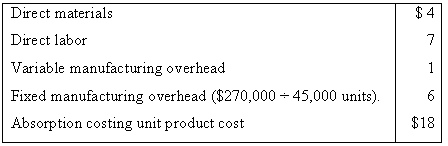

The company’s $18 unit product cost is computed as follows:

Forty percent of fixed manufacturing overhead consists of wages and salaries; the remainder consists of depreciation charges on production equipment and buildings.

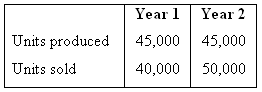

Production and cost data for the two years are:

Required:

1. Prepare a variable costing contribution format income statement for each year.

2. Reconcile the absorption costing and the variable costing net operating income figures for each year.

Year 1 Year 2 $1,000,000 $1,250,000 Sales (@ $25 per unit) Cost of goods sold (@ $18 per unit) Gross margin Selling and administrative expenses* 720,000 280,000 900,000 350,000 230,000 210,000 $ 70,000 $ 120,000 Net operating income *s2 per unit variable; $130,000 fixed each year.

Step by Step Solution

3.47 Rating (173 Votes )

There are 3 Steps involved in it

1 The unit product cost under variable costing is computed as follows Direct materials 4 Direct labo... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-V-C (21).docx

120 KBs Word File