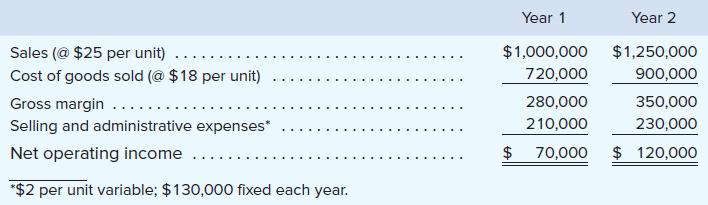

During Heaton Companys first two years of operations, it reported absorption costing net operating income as follows:

Question:

During Heaton Company’s first two years of operations, it reported absorption costing net operating income as follows:

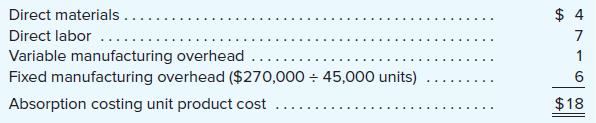

The company’s $18 unit product cost is computed as follows:

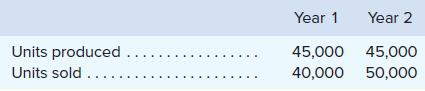

Production and cost data for the first two years of operations are:

Required:

1. Using variable costing, what is the unit product cost for both years?

2. What is the variable costing net operating income in Year 1 and in Year 2?

3. Reconcile the absorption costing and the variable costing net operating income figures for each year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting

ISBN: 9781260247787

17th Edition

Authors: Ray Garrison, Eric Noreen, Peter Brewer

Question Posted: