Question: Duval Co. issues four-year bonds with a $100,000 par value on January 1, 2017, at a price of $95,952. The annual contract rate is 7%,

Duval Co. issues four-year bonds with a $100,000 par value on January 1, 2017, at a price of $95,952. The annual contract rate is 7%, and interest is paid semiannually on June 30 and December 31.

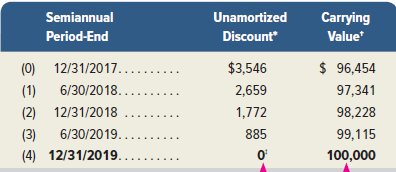

1. Prepare an amortization table like the one in Exhibit 14.7 for these bonds. Use the straight-line method of interest amortization.

2. Prepare journal entries to record the first two interest payments.

3. Prepare the journal entry for maturity of the bonds on December 31, 2020 (assume semiannual interest is already recorded).

Exhibit 14.7

Semiannual Unamortized Carrying Period-End Discount Value $ 96,454 (0) 12/31/2017.... $3,546 (1) 6/30/2018..... 2,659 97,341 (2) 12/31/2018 ... 1,772 98,228 6/30/2019.... 99,115 (3) 885 (4) 12/31/2019. 100,000

Step by Step Solution

3.35 Rating (164 Votes )

There are 3 Steps involved in it

1 Straightline amortization table 100000959528 506 Semiannual PeriodEnd Unamortized Discount Carryin... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1203-B-C-A-P-C(1450).docx

120 KBs Word File