Question: Quatro Co. issues bonds dated January 1, 2017, with a par value of $400,000. The bonds' annual contract rate is 13%, and interest is paid

Quatro Co. issues bonds dated January 1, 2017, with a par value of $400,000. The bonds' annual contract rate is 13%, and interest is paid semiannually on June 30 and December 31. The bonds mature in three years. The annual market rate at the date of issuance is 12%, and the bonds are sold for $409,850.

1. What is the amount of the premium on these bonds at issuance?

2. How much total bond interest expense will be recognized over the life of these bonds?

3. Prepare an amortization table like the one in Exhibit 14B.2 for these bonds; use the effective interest method to amortize the premium.

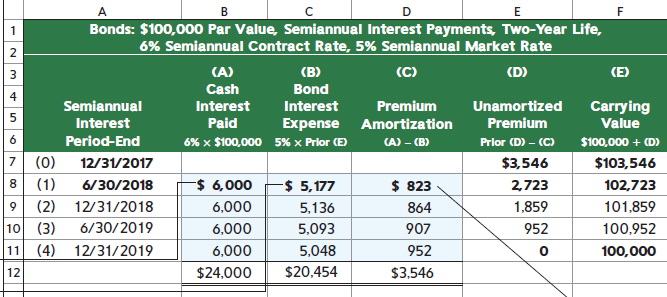

Exhibit 14B.2

Bonds: $100,000 Par Value, Semiannual Interest Payments, Two-Year Life, 6% Semiannual Contract Rate, 5% Semiannual Market Rate (C) (D) (E) (A) (B) Cash Bond Semiannual Interest Interest Premium Unamortized Carrying Interest Paid Expense Premium Value Amortization Period-End 6% x $100,000 5% x Prior (E) Prior (D) (C) $100,000 + (D) CA) (B) 7 (0) $3,546 $103,546 12/31/2017 $ 5,177 $ 6,000 $ 823 (1) 6/30/2018 2,723 102,723 (2) 12/31/2018 1,859 6,000 101,859 5,136 864 10 (3) (4) 6/30/2019 6,000 5,093 907 952 100,952 6,000 11 12/31/2019 5,048 952 100,000 $20,454 $3,546 $24,000 12

Step by Step Solution

3.30 Rating (162 Votes )

There are 3 Steps involved in it

1 Premium Issue price Par value 409850 400000 9850 2 Total bond interest expense over the life ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1203-B-C-A-P-C(1449).docx

120 KBs Word File