Question: Dwyer Company is considering two investment projects. Relevant cost and cash flow information on the two projects is given below: The trucks would have a

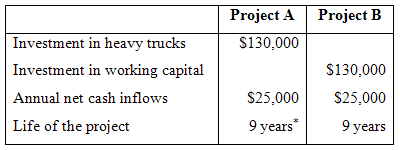

Dwyer Company is considering two investment projects. Relevant cost and cash flow information on the two projects is given below:

The trucks would have a $15,000 salvage value in nine years. For tax purposes, the company computes depreciation deductions assuming zero salvage value and uses straight-line depreciation. The trucks will be depreciated over five years. At the end of nine years, the working capital will be released for use elsewhere. The company requires an after-tax return of 12% on all investments. The tax rate is 30%.

Required:

Compute the net present value of each investment project. Round to the nearest whole dollar.

Project A Project B Investment in heavy trucks Investment in working capital Annual net cash inflows Life of the project S130,000 $130,000 $25,000 9 years" S25,000 9 years

Step by Step Solution

3.31 Rating (172 Votes )

There are 3 Steps involved in it

Items and Computations Years 1 Amount 2 Tax Effect 1 2 AfterTa... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-B-D (53).docx

120 KBs Word File