Question: Efferson Electronics manufactures two large-screen television models. The 32-inch flat-panel LCD model has been in production since 2009 and sells for $900. The company introduced

Efferson Electronics manufactures two large-screen television models. The 32-inch flat-panel LCD model has been in production since 2009 and sells for $900. The company introduced a 42-inch plasma HDTV in 2011; it sells for $1,140.

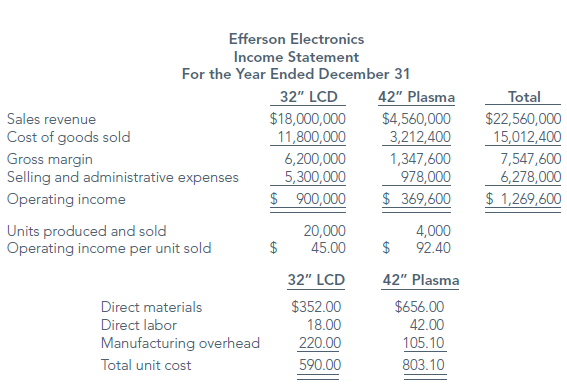

The company's income statement for the current year follows. Based on these results, management has decided to concentrate the company's marketing efforts on the plasma HDTV model and begin to phase out the LCD model.

Jon Daniel, Efferson’s controller, just attended a seminar on activity-based costing and believes the company should implement such a system. He has gathered the following annual information to explore the possibility.

Required

a. Calculate the activity rate for each activity cost pool.

b. Allocate overhead costs to each of the products using activity-based costing.

c. Calculate the total product cost of each product using activity-based costing.

d. Are the product costs you calculated in part (c) the total costs of the two products?

Why or why not?

e. Evaluate Efferson’s decision to focus on the 42-inch plasma television and phase out the 32-inch LCD television.

f. In what other ways could Efferson Electronics use the activity-based cost information calculated in partc?

Efferson Electronics Income Statement For the Year Ended December 31 32" LCD Total 42" Plasma Sales revenue $18,000,000 11,800,000 $4,560,000 3,212,400 $22,560,000 15,012,400 7,547,600 6,278,000 $ 1,269,600 Cost of goods sold Gross margin Selling and administrative expenses 6,200,000 5,300,000 $ 900,000 1,347,600 978,000 $ 369,600 Operating income Units produced and sold Operating income per unit sold 20,000 45.00 4,000 92.40 32" LCD 42" Plasma $352.00 $656.00 Direct materials Direct labor 18.00 42.00 Manufacturing overhead 220.00 105.10 Total unit cost 590.00 803.10

Step by Step Solution

3.30 Rating (174 Votes )

There are 3 Steps involved in it

a Cost Pool Calculation Activity Rate Soldering 060joint Shipping 43shipment Quality control 16inspection Purchasing 5purchase order Machining 040mach... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

281-B-M-A-A-B-C (964).docx

120 KBs Word File