Question: Consider the case of the firm with secured debt, subordinated debentures, and common stock, where the secured debt and subordinated debentures mature at the same

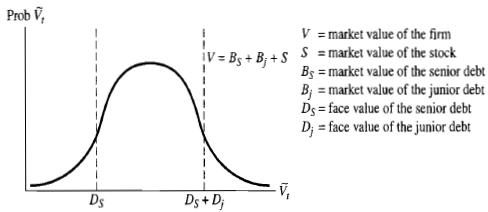

Consider the case of the firm with secured debt, subordinated debentures, and common stock, where the secured debt and subordinated debentures mature at the same time. Find the equations for the values of the three classes of securities using the OPM framework. Assume no dividends or interest payments prior to the debt’s maturity and a lognormal distribution of the future value of the firm’s assets, ![]() as shown in Fig. Q7.9, where V = market value of the firm, S = market value of the stock, Bs = market value of the senior debt, Bj = market value of the junior debt, Ds = face value of the senior debt, Dj = face value of the junior debt.

as shown in Fig. Q7.9, where V = market value of the firm, S = market value of the stock, Bs = market value of the senior debt, Bj = market value of the junior debt, Ds = face value of the senior debt, Dj = face value of the junior debt.

Figure Q7.9

Prob V V market value of the firm V B+B+S market value of the stock B, market value of the senior debt B, - market value of the junior debt Ds face value of the senior debt D, face value of the junior debt Ds+ D

Step by Step Solution

3.32 Rating (170 Votes )

There are 3 Steps involved in it

As far as the senior debt is concerned there is no difference between having only common stock or ha... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

897-B-C-F-G-F (3196).docx

120 KBs Word File