Question: Financial data for Joel de Paris, Inc., for last year follow: The company paid dividends of $15,000 last year. The Investment in Buisson, S.A., on

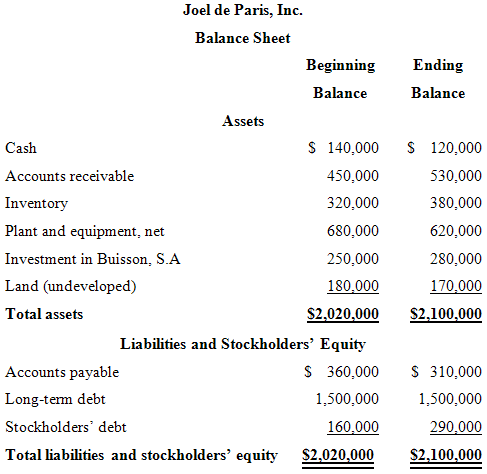

Financial data for Joel de Paris, Inc., for last year follow:

The company paid dividends of $15,000 last year. The “Investment in Buisson, S.A.,” on the balance sheet represents an investment in the stock of another company.

Required:

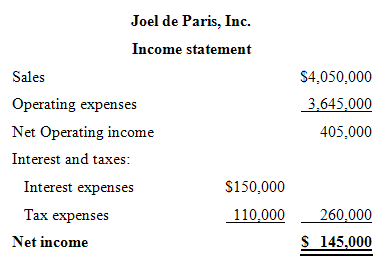

1. Compute the company’s margin, turnover, and return on investment (ROT) for last year.

2. The board of directors of Joel de Paris, Inc., has set a minimum required rate of return of 15%. What was the company’s residual income last year?

Joel de Paris, Inc. Balance Sheet Beginning Ending Balance Balance Assets $ 140,000 $ 120,000 Cash Accounts receivable 450,000 530,000 380,000 Inventory 320,000 Plant and equipment, net 680,000 620,000 Investment in Buisson, S.A 250,000 280,000 Land (undeveloped) 180,000 170,000 Total assets $2,020,000 $2,100,000 Liabilities and Stockholders' Equity $ 360,000 S 310,000 Accounts payable 1,500,000 Long-tem debt 1,500,000 Stockholders' debt 160,000 290,000 Total liabilities and stockholders' equity $2,020,000 $2,100,000

Step by Step Solution

3.40 Rating (172 Votes )

There are 3 Steps involved in it

1 Operating assets do not include investments in other com... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-D-B-S (34).docx

120 KBs Word File