Question: For several years, Conrad Stone had wanted to acquire the Pineview Motel. The motel had a prime location and was thriving. Part of its property

For several years, Conrad Stone had wanted to acquire the Pineview Motel. The motel had a prime location and was thriving. Part of its property was adjacent to a scenic river, which was used as a picnic area for guests.

Stone felt that if he acquired the property, he could continue to operate the motel business but could also piece off its excess land along the river and develop a condominium project. Although the river frontage was not zoned for that purpose, Stone felt that with some effort, this could be changed.

The motel and the land were owned by Henson Enterprises Ltd., a corporation owned by Sheila Henson. She had refused two previous offers from Stone for the land, building, and equipment of the motel, partly because her corporation would have been heavily taxed on the sale.

After further pressure from Stone, Henson agreed to sell, provided that Stone purchased her shares of Henson Enterprises. In this manner, she would be able to claim the maximum capital gain deduction on the sale.

The most recent balance sheet of Henson Enterprises is shown at the top of the next page. The retained earnings of the corporation are relatively low because Henson has withdrawn most of the earnings through regular dividend distributions.

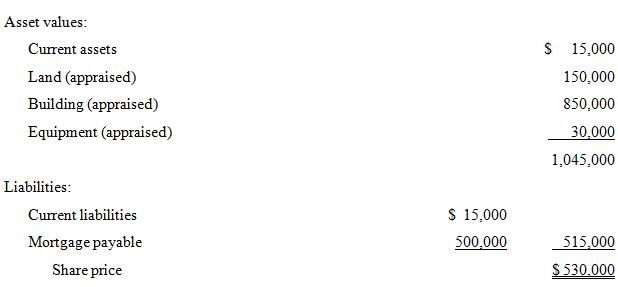

Over the years, Henson has claimed accounting amortization at a rate equal to the capital cost allowance rate permitted for tax purposes. At the end of the most recent year, the undepreciated capital cost was $350,000 for the building and $30,000 for the equipment. To determine the share price, Henson first obtained an independent appraisal of the land, building, and equipment. She then suggested a price of $530,000, calculated as follows:

Stone realized that buying the shares at that price would be a problem because the corporation would retain a potential tax liability in the event that its property is ever sold. After negotiations, Henson dropped the price to $450,000 and Stone purchased the shares for that amount of cash. Stone was not overly concerned about the corporation’s tax liability, as the reduced price would provide some relief and he had no intention of selling the property. He would continue to operate the motel and begin to develop the condominium project.

Balance Sheet

Assets

Current Assets | $ 15,000 | |

Land (at cost) | 100,000 | |

Building (at cost) | $ 700,000 | |

Equipment (at cost) | 100,000 | |

800,000 | ||

Accumulated amortization | (370,000) | 430,000 |

$545,000 |

Liabilities and Shareholder’s Equity

Current liabilities | $ 15,000 | |

Mortgage payable | 500,000 | |

| 515,000 | |

Shareholder’s equity: | ||

Common shares | $ 1,000 | |

Retained earnings | 29,000 | 30,000 |

| $545,000 |

To purchase the shares, Stone used $50,000 of his savings and borrowed $400,000 from his bank, using his personal residence and the acquired shares as collateral. The bank loan is payable on demand.

Two months after Stone purchased the shares, the city announced that it intended to expropriate all of the motel’s property to develop a riverbank park. The city had the property appraised and told Henson Enterprises that it would pay the appraised amount for the land, building, and equipment. The appraisal values arrived at by the city were the same as those obtained by Henson two months earlier.

Henson Enterprises has a tax rate of 15% on income subject to the small-business deduction, 25% on other business income, and 44 2/3% on investment income. Stone has a marginal tax rate of 28% on eligible dividends and 35% on non-eligible dividends received (net of the dividend tax credit) and 45% on other income. Prior to the expropriation, all business income earned by Henson Enterprises had been eligible for the small business deduction.

Required:

1. Determine the tax liability of Henson Enterprises as a result of the expropriation.

2. Determine what Stone’s financial position will be after he repays his bank loan.

3. Would the result in 2 have been different if Stone had organized a holding corporation to borrow from the bank and purchase the shares? Explain, providing the calculations.

Asset values: Current assets Land (appraised) Building (appraised) Equipment (appraised) S 15,000 150,000 850,000 30.000 1,045,000 Liabilities S 15,000 Current liabilities Mortgage payable Share price 500000 515,000 S 530000

Step by Step Solution

3.50 Rating (170 Votes )

There are 3 Steps involved in it

This problem highlights the importance for a purchaser of corporate shares of assessing the impact of potential tax liabilities that are inherited with the change in corporate ownership It also emphas... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

691-L-B-L-I-T-E (1089).docx

120 KBs Word File