Question: Garlington Technologies Inc.'s 2010 financial statements are shown below: Balance Sheet as of December 31, 2010 Suppose that in 2011 sales increase by 10% over

Garlington Technologies Inc.'s 2010 financial statements are shown below:

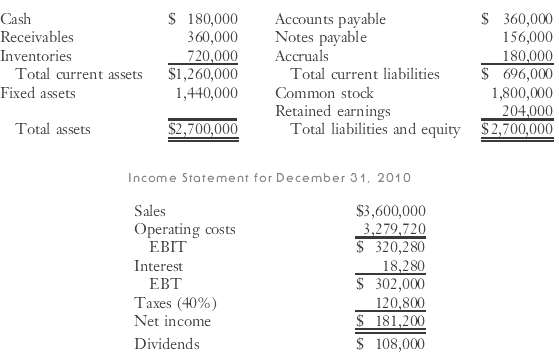

Balance Sheet as of December 31, 2010

Suppose that in 2011 sales increase by 10% over 2010 sales and that 2011 dividends will increase to $112,000. Forecast the financial statements using the forecasted financial statement method. Assume the firm operated at full capacity in 2010. Use an interest rate of 13%, and assume that any new debt will be added at the end of the year (so forecast the interest expense based on the debt balance at the beginning of the year). Cash does not earn any interest income. Assume that the AFN will be in the form of notespayable.

$ 360,000 156,000 S 180,000 360,000 Accounts payable Notes payable Accruals Cash Receivables Inventories 720,000 $1,260,000 180,000 $ 696,000 1,800,000 204,000 Total liabilities and equity $2,700,000 Total current assets Total current liabilities Fixed assets 1,440,000 Common stock Retained earnings $2,700,000 Total assets Income Statement for December 31, 2010 Sales $3,600,000 Operating costs EBIT 3,279,720 $ 320,280 18,280 $ 302,000 120,800 $ 181,200 S 108,000 Interest EBT Taxes (40%) Net income Dividends

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

The Excel spreadsheet would look like this after using Excels Goal Seek to add the calculated AFN to ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

49-B-C-F-I-C-F (39).docx

120 KBs Word File