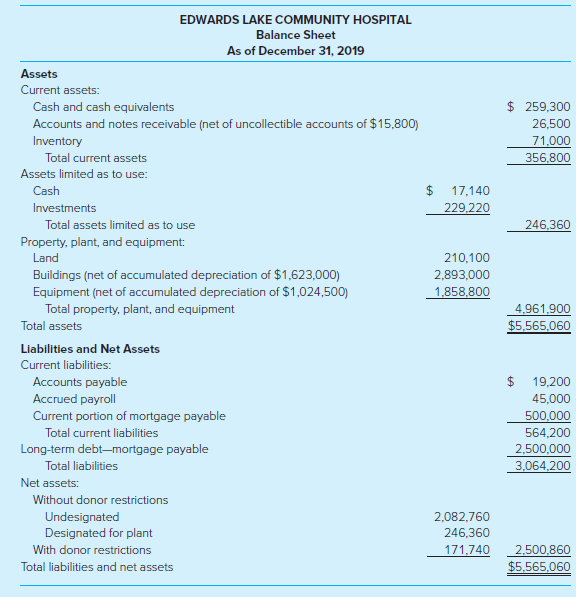

The Edwards Lake Community Hospital balance sheet as of December 31, 2019, follows. Required a. Record in

Question:

Required

a. Record in general journal form the effect of the following transactions during the fiscal year ended December 31, 2020, assuming that Edwards Lake Community Hospital is a not-for-profit hospital.

1. Information related to accrual of revenues and gains is as follows:

Patient services revenue, gross ....................................................................................$3,500,900

Charity care ..........................................................................................................................211,260

Contractual adjustments to patient service revenues .................................................1,520,000

Other operating revenues ..................................................................................................998,750

2. Cash received includes

Interest on investments in Assets Limited as to Use ..........................................................7,350

Collections of receivables ...............................................................................................2,960,600

3. Expenses of $891,000 were recorded in accounts payable and $1,454,390 in accrued payroll. Because some of the nursing expenses met a net asset restriction, $94,000 was released from restrictions.

Administration expenses ..........................................................................446,480

General services expenses .......................................................................524,360

Nursing services expenses ....................................................................1,031,800

Other professional services expenses ....................................................342,750

4. Cash paid includes

Interest expense (allocated half to nursing services

and half to general services) .....................................................................280,000

Payment on mortgage principal ...............................................................500,000

Accounts payable for purchases ..............................................................836,800

Accrued payroll .......................................................................................1,279,500

5. Interest of $1,180 accrued on investments in Assets Limited as to Use.

6. Depreciation charges for the year amounted to $117,000 for the buildings and $128,500 for equipment. Depreciation was allocated 45 percent to nursing services, 15 percent to other professional services, and 20 percent each to administrative and general services.

7. Other information:

(a) Provision for uncollectible receivables was determined to be adequate.

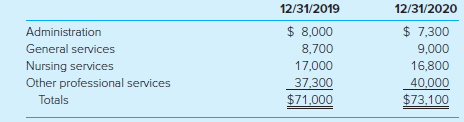

(b) Supplies inventory balances:

(c) Portion of mortgage payable due within one year, $500,000.

8. A $663 unrealized loss on investments occurred.

9. Nominal accounts were closed. Necessary adjustments were made to increase the Net Assets€”Without Donor Restrictions, Designated for Plant.

b. Prepare a balance sheet as of December 31, 2020.

c. Prepare a statement of operations for the year ended December 31, 2020.

d. Prepare a statement of cash flows for the year ended December 31, 2020.

Step by Step Answer: