Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China

Question:

Gold Nest Company of Guandong, China, is a family-owned enterprise that makes birdcages for the South China market. A popular pastime among older Chinese men is to take their pet birds on daily excursions to teahouses and public parks where they meet with other bird owners to talk and play mahjong. A great deal of attention is lavished on these birds, and the birdcages are often elaborately constructed from exotic woods and contain porcelain feeding bowls and silver roosts. Gold Nest Company makes a broad range of birdcages that it sells through an extensive network of Street vendors who receive commissions on their sales. The Chinese currency is the renminbi, which is denoted by Rmb. All of the company’s transactions with customers, employees, and suppliers are conducted in cash; there is no credit.

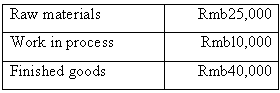

The company uses a job-order costing system in which overhead is applied to jobs on the basis of direct labor cost. At the beginning of the year, it was estimated that the total direct labor cost for the year would be Rmb200,000 and the total manufacturing overhead cost would be Rmb330,000. At the beginning of the year, the inventory balances were as follows:

During the year, the following transactions were completed:

a. Raw materials purchased for cash, Rmb275,000.

b. Raw materials requisitioned for use in production, Rmb280,000 (materials costing Rmb220,000 were charged directly to jobs; the remaining materials were indirect).

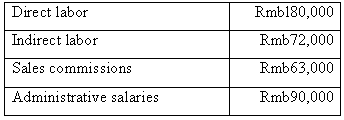

c. Costs for employee services were incurred as follows:

d. Rent for the year was Rmb18,000 (Rmb13,000 of this amount related to factory operations, and the remainder related to selling and administrative activities).

e. Utility costs incurred in the factory, Rmb57,000.

f. Advertising costs incurred, Rmb140,000.

g. Depreciation recorded on equipment, Rmb100,000. (Rmb8 8,000 of this amount was on equipment used in factory operations; the remaining Rmbl2,000 was on equipment used in selling and administrative activities.)

h. Manufacturing overhead cost was applied to jobs, Rmb?

i. Goods that had cost Rmb675,000 to manufacture according to their job cost sheets were completed.

j. Sales for the year totaled Rmb1,250,000. The total cost to manufacture these goods according to their job cost sheets was Rmb700,000.

Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for inventories, Manufacturing Overhead, and Cost of Goods Sold. Post relevant data from your journal entries to these T-accounts (don’t forget to enter the beginning balances in your inventory accounts). Compute an ending balance in each account.

3. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold.

4. Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.)

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer