Question: Almeda Products, Inc., uses a job-order costing system. The companys inventory balances on April 1, the start of its fiscal year, were as follows: During

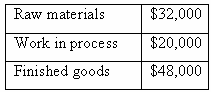

Almeda Products, Inc., uses a job-order costing system. The company’s inventory balances on April 1, the start of its fiscal year, were as follows:

During the year, the following transactions were completed:

a. Raw materials were purchased on account, $170,000.

b. Raw materials were issued from the storeroom for use in production, $180,000 (80% direct and 20% indirect).

c. Employee salaries and wages were accrued as follows: direct labor, $200,000; indirect labor, $82,000; and selling and administrative salaries, $90,000.

d. Utility costs were incurred in the factory, $65,000.

e. Advertising costs were incurred, $100,000.

f. Prepaid insurance expired during the year, $20,000 (90% related to factory operations, and 10% related to selling and administrative activities).

g. Depreciation was recorded, $180,000 (85% related to factory assets, and 15% related to selling and administrative assets).

h. Manufacturing overhead was applied to jobs at the rate of 175% of direct labor cost.

i. Goods that cost $700.000 to manufacture according to their job cost sheets were transferred to the finished goods warehouse.

j. Sales for the year totaled $1,000,000 and were all on account. The total cost to manufacture these goods according to their job cost sheets was $720,000.

Required:

1. Prepare journal entries to record the transactions for the year.

2. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, Manufacturing Overhead, and Cost of Goods Sold. Post the appropriate parts of your journal entries to these T-accounts. Compute the ending balance in each account. (Don’t forget to enter the beginning balances in the inventory accounts.)

3. Is Manufacturing Overhead underapplied or overapplied for the year? Prepare a journal entry to close this balance to Cost of Goods Sold.

4. Prepare an income statement for the year. (Do not prepare a schedule of cost of goods manufactured; all of the information needed for the income statement is available in the journal entries and T-accounts you have prepared.)

$32,000 Raw materials Work in process $20,000 Finished goods $48,000

Step by Step Solution

3.35 Rating (173 Votes )

There are 3 Steps involved in it

1 a Raw Materials 170000 Accounts Payable 170000 b Work in Process 144000 Manufacturing Overhead 360... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-S-D (38).docx

120 KBs Word File