GOW Inc. purchases used mining equipment, refurbishes it, and sells it to mining companies around the world.

Question:

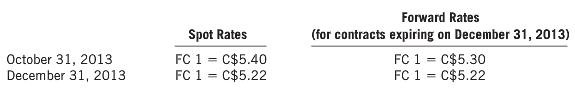

GOW Inc. purchases used mining equipment, refurbishes it, and sells it to mining companies around the world. On October 31, 2013, GOW ordered some used mining equipment from a company in a foreign country for 100,000 foreign currency units (FC). On December 31, 2013, the equipment was delivered with payment made on delivery. On October 31, 2013, GOW entered into a forward contract with a bank to buy FC 100,000 on December 31, 2013. On December 31, 2013, GOW settled the forward contract with the bank, paid the supplier, and recorded year-end adjusting journal entries relating to these accounts. Exchange rates were as follows:

Required

(a) Determine the net cash outflow in Canadian dollars for the combined purchase of the equipment and the forward contract, assuming that the forward contract is designated as:

1. A cash flow hedge

2. A speculative contract

(b) Determine the carrying amount of the equipment at December 31, 2013, the exchange gains or losses reported in net income for 2013, and the exchange gains or losses reported in other comprehensive income for 2013, assuming that the forward contract is designated as:

1. A cash flow hedge

2. A speculative contract

(c) Briefly explain which of the reporting methods in part (b) better reflects the economic substance of the situation.

Step by Step Answer: