Question: Hasbro and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders?? equity from a recent balance sheet are shown

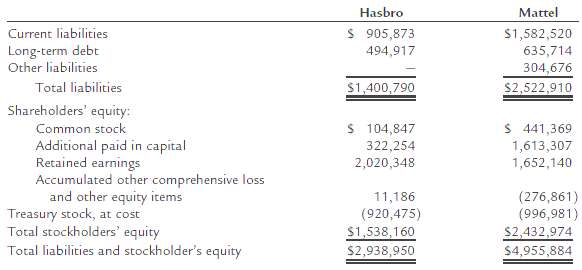

Hasbro and Mattel, Inc., are the two largest toy companies in North America. Condensed liabilities and stockholders?? equity from a recent balance sheet are shown for each company as follows (in thousands):

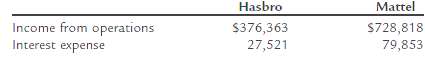

The income from operations and interest expense from the income statement for both companies were as follows:

a. Determine the ratio of liabilities to stockholders?? equity for both companies. Round to one decimal place.b. Determine the number of times interest charges are earned for both companies. Round to one decimal place.c. Interpret the ratio differences between the twocompanies.

Mattel Hasbro S 905,873 Current liabilities $1,582,520 Long-term debt Other liabilities 494,917 635,714 304,676 Total liabilities $1,400,790 $2,522,910 Shareholders' equity: S 104,847 $ 441,369 Common stock Additional paid in capital Retained earnings Accumulated other comprehensive loss and other equity items Treasury stock, at cost Total stockholders' equity Total liabilities and stockholder's equity 322,254 1,613,307 1,652,140 2,020,348 11,186 (920,475) (276,861) (996,981) $1,538,160 $2,938,950 $2,432,974 $4,955,884

Step by Step Solution

3.38 Rating (164 Votes )

There are 3 Steps involved in it

a b c Both companies carry a moderate proportion of debt to ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-M-A-F-S-A (90).docx

120 KBs Word File