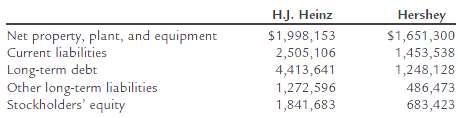

Question: Recent balance sheet information for two companies in the food industry, H.J. Heinz Company and The Hershey Company, are as follows (in thousands of dollars):

Recent balance sheet information for two companies in the food industry, H.J. Heinz Company and The Hershey Company, are as follows (in thousands of dollars):

a. Determine the ratio of liabilities to stockholders?? equity for both companies. Round to one decimal place.b. Determine the ratio of fixed assets to long-term liabilities for both companies. Round to one decimal place.c. Interpret the ratio differences between the twocompanies.

H.J. Heinz $1,998,153 2,505,106 4,413,641 1,272,596 1,841,683 Hershey Net property, plant, and equipment Current liabilities Long-term debt Other long-term liabilities $1,651,300 1,453,538 1,248,128 486,473 683,423 Stockholders' equity

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

a b c HJ Heinz uses more debt than does Hershey While the total liabilities to stockholders equity r... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

59-B-M-A-F-S-A (91).docx

120 KBs Word File