Health Kicks Ltd. is a Canadian-controlled private corporation owned 100% by Wally Bose. The companys yearend is

Question:

Health Kicks Ltd. is a Canadian-controlled private corporation owned 100% by Wally Bose. The company’s yearend is December 31, and its 20X1 fiscal period has just come to a close.

Following is certain information in the accounting records of the company for the year ended December 31, 20X1:

Rent expense ($22,000)

The company rents a warehouse building for $2,000 per month from Joe Holy, a schoolteacher. As of December 31, 20X1, the December rent had not been paid owing to an employee error. Holy had purchased the building as an investment several years ago for $180,000. During 20X1, he incurred operating expenses for the building (taxes, insurance, interest, and the like) totalling $20,000.The undepreciated capital cost (UCC) of the building is $120,000.

Repairs and maintenance expense ($70,000)

This account includes snow removal and lawn-care costs, in addition to $62,000 for building improvements: the installation of an air-conditioning system and three additional loading docks (ramps and doors). The $62,000 was paid to a warehouse contractor that is an American corporation operating a branch office in Winnipeg.

Accounting and legal expense ($16,000)

This amount was paid to a law firm for the following services:

— Registering of a debenture against the company’s assets on a loan from the bank ($4,000).

— Drawing up of a legal agreement to purchase all of the common shares of Dash Ltd. which now operates as a wholly owned subsidiary ($9,000).

— Preparing of articles of amendment to revise the company’s articles of incorporation ($3,000).

Interest expense ($22,000)

Several years ago, the company purchased a small warehouse in Winnipeg. The previous owner, a resident of England, permitted Health Kicks to pay a small amount down and the balance over eight years, with interest at 11%. Of the above interest, $7,000 represents interest paid on this obligation. The remaining interest of $15,000 was paid to a shareholder, Bose, on a loan he made to his own company.

Land cost ($19,000)

This represents the cost of landscaping the grounds around the company’s office building (trees, shrubs, and flower beds), and was added to the capital cost of the land. The $19,000 was paid to Wesley Perkins, a management student who operates a summer lawn service.

Salary and remuneration expense ($290,000)

This account is made up of the following items:

Salaries ……………………………………………………………….. $238,000

Sales commissions accrued but not paid until 20X2 ………………… 30,000

Retirement gift to the sales manager …………………………………….. 1,000

Clothing allowance to senior executives so that they can acquire

expensive wardrobes to maintain their image …………………………… 21,000

……………………………………..……………………………… $290,000

Licence cost ($120,000)

Health Kicks purchased a licence to manufacture a health product that was patent-protected by another company. The licence permitted Health Kicks to manufacture and sell the product for six years. The licence was acquired from Bobo Enterprises Ltd., which sold several licences for this product to other companies in certain geographic areas. Health Kicks can sell the product only in western Canada.

Required:

Discuss, in point form, the tax implications of the preceding transactions from the point of view of (a) Health Kicks, and (b) the other party to each transaction.

Rent

Health Kicks….. deducts full rent of $24,000 on the accrual basis.

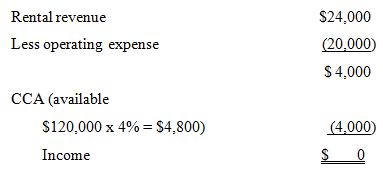

Holy………… # rental activity is property income, therefore, the rent receivable is included in rental revenues on the accrual basis in 20X1. However, deductions are limited due to CCA restriction on rental properties [Reg. 1100(11)].

Repairs and Maintenance

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold