Question: High-low method, alternative regression functions, accrual accounting adjustments, ethics. Trevor Kennedy, the cost analyst at a can manufacturing plant of United Packaging, is examining the

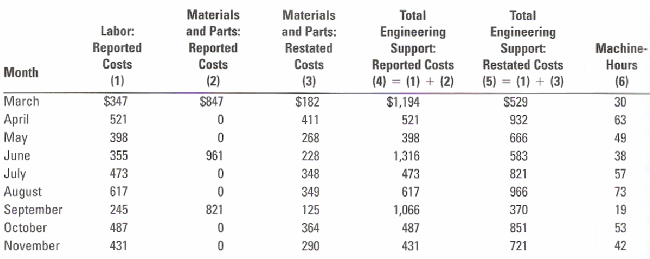

High-low method, alternative regression functions, accrual accounting adjustments, ethics. Trevor Kennedy, the cost analyst at a can manufacturing plant of United Packaging, is examining the relationship between total engineering support costs reported in the plant records and machine-hours. These costs have two components: (1) labor, which is paid monthly, and (2) materials and parts, which are purchased from an outside vendor every three months, After further discussion with the operating manager, Kennedy discovers that the materials and parts numbers reported in the monthly records are on an “as purchased” or cash accounting basis and not on an “as used” or accrual accounting basis. By examining materials and parts usage records, Kennedy is able to restate the materials and parts costs to an “as used” basis. (No restatement of the labor costs was necessary.) The reported and restated costs are as follows:

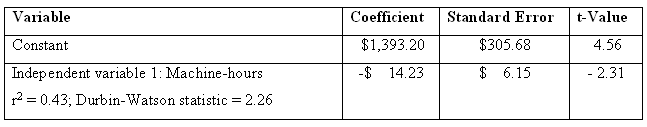

The regression results for total engineering support reported costs as the dependent variable, are:

Regression 1: Engineering support reported costs = a + (b × Machine-hours)

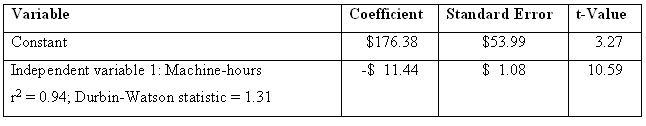

The regression results for total engineering support restated costs as the dependent variable, are:

Regression 2: Engineering support restated costs = a + (b × Machine-hours)

1. Plot the cost functions relating (i) the reported costs for total engineering support to machine-hours and (ii) the restated costs for total engineering support to machine-hours. Comment on the plots.

2. Use the high-low method to compute estimates of the cost functions y = a + bX for (a) reported engineering support costs and machine-hours and (b) restated engineering support costs and machine-hours.

3. Contrast and evaluate the cost function estimated with regression analysis using restated data for materials and parts with the cost function estimated with regression analysis using the data reported in the plant records. Use the comparison format employed in Exhibit 10-18.

4. Of all the cost functions estimated in requirements 2 and 3, which one would you choose to best represent the relationship between engineering support costs and machine-hours? Explain briefly.

5. What problems might Kennedy encounter when restating the materials and parts costs recorded to an “as used” or accrual accounting basis?

6. Why is it important for Kennedy to choose the correct cost function? That is, illustrate two potential problems Kennedy could encounter by choosing a cost function other than the one you chose in requirement 4.

7. John Mason, the plant manager, is not pleased when he sees the restated numbers. He tells Kennedy, “I think the restated engineering support costs are too high. Please recheck your numbers. They ought to be lower.” Kennedy is aware that lower costs will result in a higher bonus for Mason. He is also certain that his numbers are correct. What should Kennedy do?

Materials and Parts: Reported Materials and Parts: Restated Total Total Engineering Labor: Reported Engineering Support: Machine- Support: Reported Costs (4) = (1) + (2) Restated Costs (5) = (1) + (3) Month Costs (1) Costs Costs Hours (2) (3) (6) 30 March $347 521 398 355 473 617 $182 411 268 228 348 349 125 $847 $529 932 666 583 821 966 $1,194 521 398 1,316 473 617 1,066 April May June 63 49 38 57 961 July August September October November 73 19 821 245 487 431 370 364 290 487 431 851 53 721 42

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

Highlow method alternative regression functions accrual accounting adjustments ethics 1 Solution Exhibit 1042A presents the two data plots The plot of engineering support reported costs and machinehou... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-C-B-M (57).docx

120 KBs Word File