Question: In addition to the five factors discussed in the chapter, dividends also affect the price of an option. The BlackScholes option pricing model with dividends

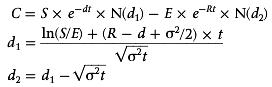

In addition to the five factors discussed in the chapter, dividends also affect the price of an option. The Black€“Scholes option pricing model with dividends is

All of the variables are the same as the Black€“Scholes model without dividends except for the variable d, which is the continuously compounded dividend yield on the stock.

a. What effect do you think the dividend yield will have on the price of a call option? Explain.

b. A stock is currently priced at $93 per share; the standard deviation of its return is 50 percent per year; and the risk-free rate is 5 percent per year, compounded continuously. What is the price of a call option with a strike price of $90 and a maturity of six months if the stock has a dividend yield of 2 percent per year?

C = Sx e-di x N(d) - Ex e x N(d) In(S/E) + (R d + o?/2) x t Rt di = Vt dz = d, - Vot

Step by Step Solution

3.46 Rating (172 Votes )

There are 3 Steps involved in it

a Going back to the chapter on dividends the price of th... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

472-B-C-F-O (377).docx

120 KBs Word File