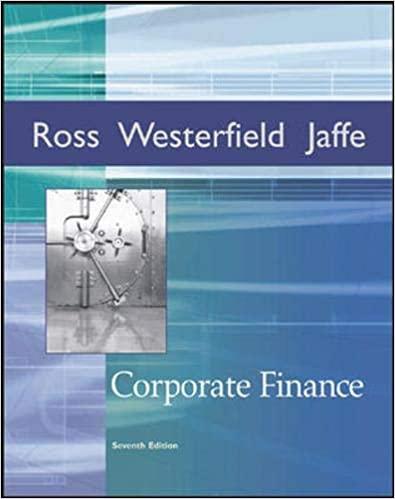

Corporate Finance(7th Canadian Edition)

Authors:

Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Gordon Ro

Type:Hardcover/ PaperBack / Loose Leaf

Condition: Used/New

In Stock: 2 Left

Shipment time

Expected shipping within 2 - 3 DaysPopular items with books

Access to 35 Million+ Textbooks solutions

Free ✝

Ask Unlimited Questions from expert

AI-Powered Answers

30 Min Free Tutoring Session

✝ 7 days-trial

Total Price:

$0

List Price: $64.74

Savings: $64.74

(100%)

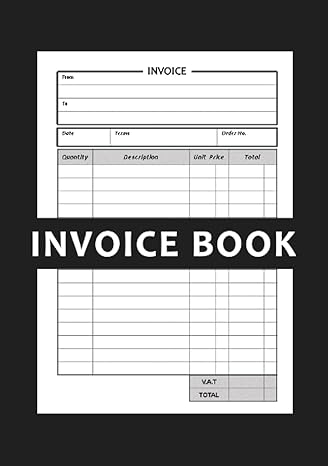

Solution Manual Includes

Access to 30 Million+ solutions

Ask 50 Questions from expert

AI-Powered Answers

24/7 Tutor Help

Detailed solutions for Corporate Finance

Price:

$9.99

/month

Book details

ISBN: 007090653X, 978-0070906532, 978-0071339575

Book publisher: McGraw-Hill Ryerson

Offer Just for You!:

Buy 2 books before the end of January and enter our lucky draw.

Book Price $0 : Corporate Finance by Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, and Gordon Ro is a seminal text in the field of finance, offering essential insights into financial management practices and theories. The 7th edition of this book has been pivotal for both students and professionals seeking to understand the complexities of corporate finance. The book covers a wide array of topics, from fundamental concepts to advanced strategies, including capital budgeting, risk management, market efficiency, and cost of capital estimation. Utilizing a blend of theoretical insights and real-world examples, it provides readers with a compelling narrative that bridges the gap between academic study and practical application. Notable tools used within the book, such as the Financial Manager's roles and principles, highlight the strategic importance of decision-making in financial settings. It also emphasizes the importance of understanding the global financial environment and its impact on corporate strategies. A crucial component of this edition is its 'solution manual' which serves as a comprehensive resource for problem-solving exercises, supplemented by an 'answer key' that provides step-by-step solutions to complex problems. The 'table of content' is meticulously organized, making it easy for readers to navigate through the extensive material covered. This book has been well-received in academic circles for its detailed analysis and clarity. LSI contextual factors include financial theory application, fiscal investment strategies, valuation methods, cash flow management, and investment risk analysis. Students will appreciate the cheap access to additional learning resources that complement the book’s core content.

Customers also bought these books

Popular Among Students

Customer Reviews

Trusted feedback from verified buyers

KK

So this showed up really fast and I gotta say it looks solid, which is great since I got this free. Wanted it for my Brampton University of Technology class and even though haven’t read much yet, the pages feel sturdy and clean. Honestly, just flipping through a few chapters the layout seems pretty straightforward, which should save some headache during exam prep. Happy it arrived without a hitch, ready to use when classes get busier. If you’re in the business courses at Brampton University of Technology, this might be a decent pick especially ’cause I didn’t have to drop cash on it.

HR

Got this for my course FIN 301: Corporate Finance Principles and since it was free I thought why not? the book looks decent and pages aren’t flimsy so thats good. i started reading a few chapters and it’s okay but not super exciting or anything, feels a bit dry so not sure if i’d actually reread it outside of class. delivery took about a week which was alright, no complaints there. overall, it does the job fine given the price (which is zero, yay free!), but if you want something more lively or easier to follow this might not be the best choice.