Question: In this simulation, you are asked to address questions regarding the accounting for property, plant, and equipment. Prepare responses to allparts. KWW Professional_Simulation 1 Property,

In this simulation, you are asked to address questions regarding the accounting for property, plant, and equipment. Prepare responses to allparts.

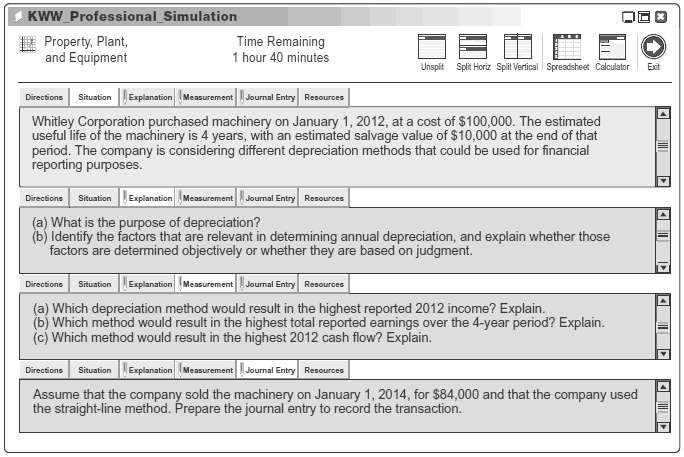

KWW Professional_Simulation 1 Property, Plant, and Equipment Time Remaining 1 hour 40 minutes Unspit Split Horiz Split Vertical Spreadsheet Calculator Exit Explanation IMeasurement Journal Entry Resources Situation Directions Whitley Corporation purchased machinery on January 1, 2012, at a cost of $100,000. The estimated useful life of the machinery is 4 years, with an estimated salvage value of $10,000 at the end of that period. The company is considering different depreciation methods that could be used for financial reporting purposes. Situation Explanation Measurement Joumal Entry Resources Directions What is the purpose of depreciation? (b) Identify the factors that are relevant in determining annual depreciation, and explain whether those factors are determined objectively or whether they are based on judgment. Situation Explanation Measurement Joumal Entry Resources Directions (a) Which depreciation method would result in the highest reported 2012 income? Explain. (b) Which method would result in the highest total reported earnings over the 4-year period? Explain. (c) Which method would result in the highest 2012 cash flow? Explain. Explanation Measurement Journal Entry Resources Directions Situation Assume that the company sold the machinery on January 1, 2014, for $84,000 and that the company used the straight-line method. Prepare the journal entry to record the transaction.

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Explanation a The purpose of depreciation is to allocate the cost or other book value of tangible plant assets less salvage over their useful lives in a systematic and rational manner Under generally ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-D-I-D (144).docx

120 KBs Word File