Question: In this simulation, you are asked to address questions regarding inventory valuation and measurement. Prepare responses to allparts. KWW Professlonal Simulation Inventory Valuation Time Remaining

In this simulation, you are asked to address questions regarding inventory valuation and measurement. Prepare responses to allparts.

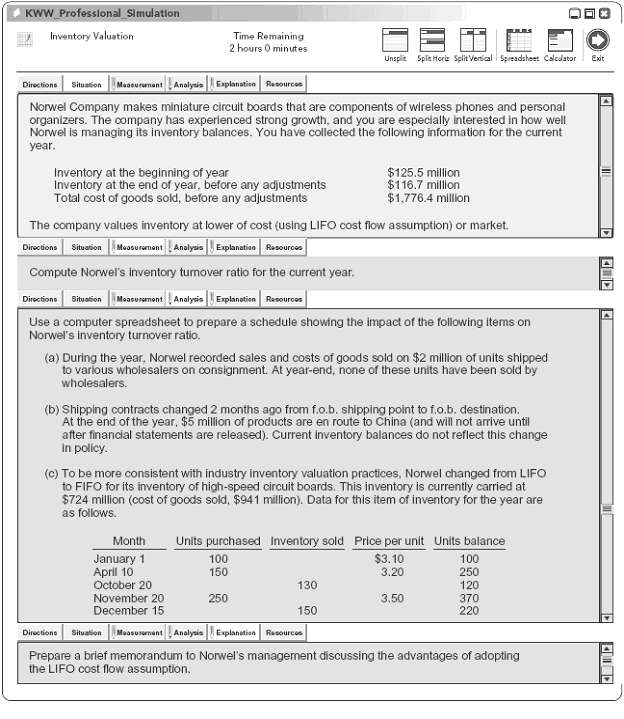

KWW Professlonal Simulation Inventory Valuation Time Remaining 2 hours O minutes Unsplit Splie Horie Split Vertical Spreadsheet Calcdator Exit Situation Meneurunant Analysia Eaplanatien Resources Directions Norwel Company makes minlature circult boards that are components of wireless phones and personal organizers. The company has experlenced strong growth, and you are especialy interested in how well Norwel is managing its inventory balances. You have collected the following information for the current year. $125.5 million Inventory at the end of year, before any adjustments Total cost of goods sold, before any adjustments $1,776.4 million The company values inventory at lower of cost (using LIFO cost flow assumption) or market. Situason Mosuremant Analysis Esplanation Rasources Directions Compute Norwel's inventory turnover ratio for the current year. Situation Measuramont Analysis Explanotion Resources Directions Use a computer spreadsheet to prepare a schedule showing the impact of the following items on Norwel's inventory turnover ratio. (a) During the year, Norwel recorded sales and costs of goods sold on $2 million of units shipped to various wholesalers on consignment. At year-end, none of these units have been sold by wholesalers. (b) Shipping contracts changed 2 months ago from f.o.b. shipping point to f.o.b. destination, after financial statements are released). Current inventory balances do not reflect this change In policy. (c) To be more consistent with industry inventory valuation practices, Norwel changed from LIFO to FIFO for its inventory of high-speed circuit boards. This inventory is currently carried at $724 million (cost of goods sold, $941 million). Data for this item of inventory for the year are as follows. Units purchased Inventory sold Price per unit Units balance Month January 1 April 10 October 20 $3. 10 3.20 100 100 250 150 130 120 November 20 December 15 250 3.50 370 150 220 Analysia Explanation Resources Directions Situalion Measurument Prepare a brief memorandum to Norwel's management discussing the advantages of adopting the LIFO cost flow assumption.

Step by Step Solution

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Explanation To Norwel Management From Student Re Advantages of LIFO The major advantages of the LIFO ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

51-B-A-V-I (205).docx

120 KBs Word File