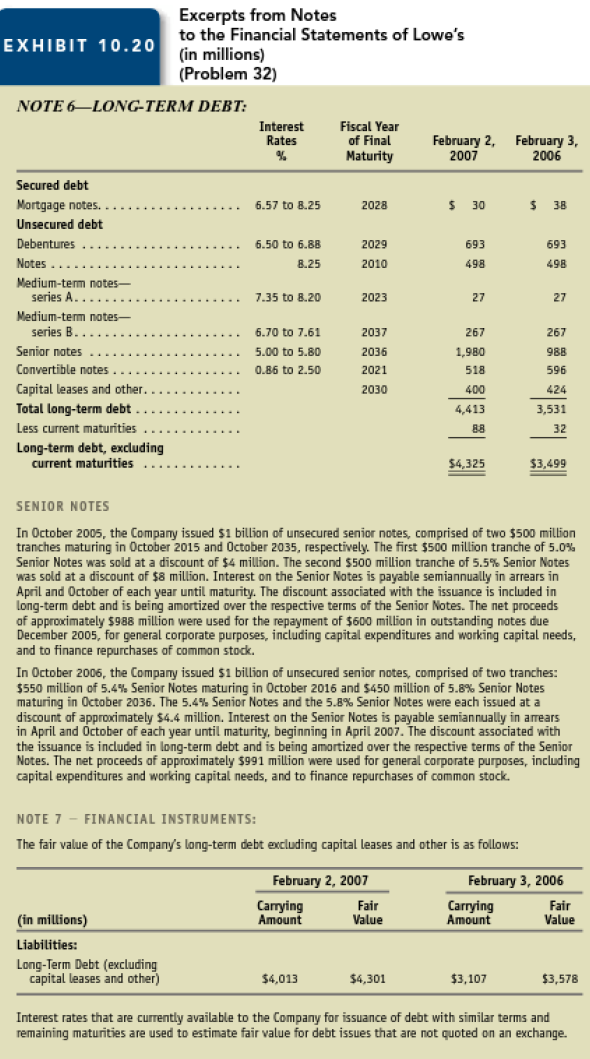

Interpreting disclosures of long-term debt. Exhibit 10.20 presents excerpts from the notes to the financial statements of

Question:

Interpreting disclosures of long-term debt. Exhibit 10.20 presents excerpts from the notes to the financial statements of Lowe’s.

a. The amounts shown for Debentures, Notes, and the Medium-Term Notes appear as the same amounts on February 3, 2006, and February 2, 2007. What is the likely interpretation for the identical reported amounts at the beginning and end of the year?

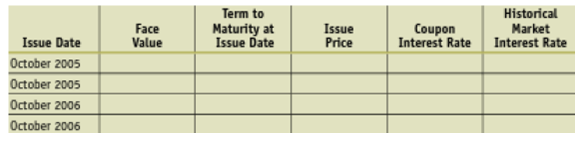

b. The Senior Notes comprise two debt issues on February 3, 2006, and an additional two debt issues on February 2, 2007. Indicate the amounts in each of the following cells. Given the face value, term to maturity, and coupon rate, use Excel to solve for the historical market interest rate. Solving for the historical market interest rate involves inputting various interest rates until the present value is within $1 million of the issue price. Be sure to consider semiannual payments and semiannual compounding. Express the coupon interest rate and the historical market interest rate in the following cells as annual rates based on semiannual compounding.

c. The amount on the balance sheet for Senior Notes on February 2, 2007, of $1,980 million slightly exceeds the total issue price of the four Senior Notes of $1,979 million (= $988 + $991). Why do the amounts differ and why is the difference so small?

d. Why are the interest rates on the convertible notes so much lower than those on Lowe’s other debt?

e. Refer to Note 7 on Financial Instruments. Is the Weighted-average historical market interest rate on long-term debt higher or lower than the weighted-average current market interest rate on February 3, 2006, and February 2, 2007? Explain.

f. Assume that Lowe’s had elected the lair value option of FASH Statement No. 159 on February 2, 2006, and February 2, 2007. Compute the amount that Lowe’s would include in net income before taxes for the fiscal year ending February 2, 2007, related to long-term debt.

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Financial Accounting an introduction to concepts, methods and uses

ISBN: 978-0324789003

13th Edition

Authors: Clyde P. Stickney, Roman L. Weil, Katherine Schipper, Jennifer Francis