Question: Using the same parameters as in Example 15.2. find the value of the 5-month call if the initial value of the stock is ($ 63).

Using the same parameters as in Example 15.2. find the value of the 5-month call if the initial value of the stock is \(\$ 63\). Hence estimate the quantity \(\Delta=\triangle C / \Delta S\). Estimate \(\Theta=\triangle C / \triangle t\).

Data from Example 15.2

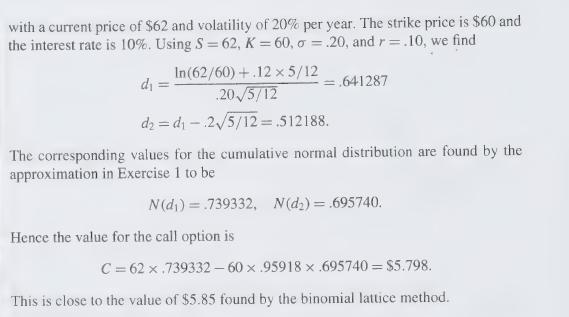

Let us calculate the value of the same option that was a 5-month call option on a stock

with a current price of $62 and volatility of 20% per year. The strike price is $60 and the interest rate is 10%. Using S = 62, K=60, o = .20, and r = .10, we find In(62/60)+.12 x 5/12 d = = .641287 .20/5/12 dz d-2/5/12= .512188. The corresponding values for the cumulative normal distribution are found by the approximation in Exercise 1 to be N(d) .739332, N(d2) = .695740. Hence the value for the call option is C=62 x .739332-60 x .95918 x .695740 = $5.798. This is close to the value of $5.85 found by the binomial lattice method.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts