Question: An investor is considering buying some land for $100,000 and constructing an office building on it. Three different buildings are being analyzed. *Resale value to

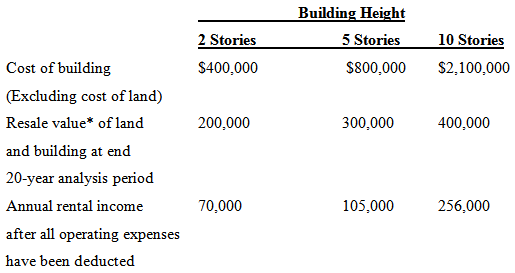

An investor is considering buying some land for $100,000 and constructing an office building on it. Three different buildings are being analyzed.

*Resale value to be considered a reduction in cost, rather than a benefit. Using benefit-cost ratio analysis and an 8% MARR, determine which alternative, if any, should be selected.

Building Height 2 Stories 5 Stories 10 Stories Cost of building $400,000 $800,000 $2,100,000 (Excluding cost of land) 400,000 Resale value* of land 200,000 300,000 and building at end 20-year analysis period Annual rental income 70,000 105,000 256,000 after all operating expenses have been deducted

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

2 Stories 5 Stories 10 Stories Cost including land 500000 900000 2200000 Annual Income A 700... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (246).docx

120 KBs Word File