Jackson Trucking Company is in the process of setting its target capital structure. The CFO believes the

Question:

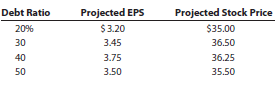

Jackson Trucking Company is in the process of setting its target capital structure. The CFO believes the optimal debt ratio is somewhere between 20% and 50%, and her staff has compiled the following projections for EPS and the stock price at various debt levels:

Assuming that the firm uses only debt and common equity, what is Jackson’s optimal capital structure? At what debt ratio is the company’s WACC minimized?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Financial Management

ISBN: 978-0324664553

Concise 6th Edition

Authors: Eugene F. Brigham, Joel F. Houston

Question Posted: