Janitorial Products, Inc., manufactures two products, brooms and mops, which are sold in two territories designated by

Question:

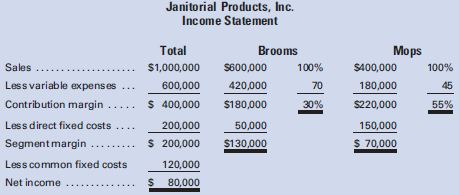

Janitorial Products, Inc., manufactures two products, brooms and mops, which are sold in two territories designated by the company as East Territory and West Territory. The following income statement prepared for the company shows the product line segments.

The territorial product sales are as follows:

The direct fixed costs of brooms ($50,000) and mops ($150,000) are not identifiable with either of the two territories. The common fixed costs are partially identifiable with East Territory, West Territory, and the general administration as follows:

East Territory . . . . . . . . . . . . . . . . . $ 54,000

West Territory . . . . . . . . . . . . . . . . . 36,000

General administration . . . . . . . . . . . 30,000

Total common fixed costs . . . . . . $120,000

Required:

1. Prepare a segmented income statement by territories. The direct fixed costs of the product lines should be treated as common fixed costs on the segmented statement being prepared.

2. What is the significance of thisanalysis?

Step by Step Answer: