John Randazzo is the owner of a successful machine shop that produces automotive brake components for national

Question:

John Randazzo is the owner of a successful machine shop that produces automotive brake components for national auto parts chains. These auto stores sell “after-market” parts to replace those made by original equipment manufacturers such as General Motors, Ford, and Toyota. A great deal of volume diversity exists across the products manufactured by Randazzo’s shop.

For example, Randazzo may produce 80,000 brake components per year for vehicles such as the Chevrolet Lumina, Ford Taurus, or Toyota Corolla; however, He may produce only 5,000 for the corvette market. Selling prices vary greatly across the product line as a result of market supply and demand.

The machine shop is highly automated and uses the most current computer-numerically controlled (CNC) equipment. By changing cutting tools and entering different measurements into the system a variety or products can be manufactured. The machine costs are not traceavle to a single product line, but are common to all products. Alternatively, Many production costs are variable and can be traced to individual products. For example, energy, material, and supply costs differ among the products.

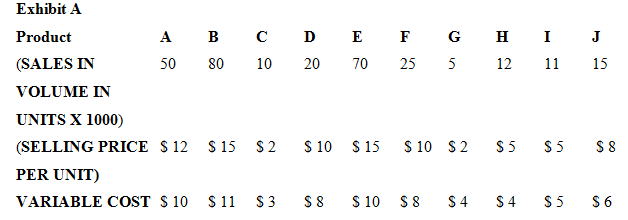

Randazzo’s cost accountant recently completed a study that associated cost and revenue data with each product listed in the company’s catalog. Exhibit A identifies sales volume, selling prices per unit, and variable costs for a sample of ten products representing the mix manufactured by Randazzo. In addition to the variable costs identified in Exhibit A, the accountant estimated $600,000 of fixed costs would be associated with the production of these ten products.

The study produced startling results: two of the ten products in the sample had variable costs exceeding their selling prices. Upon analyzing the cost report, Randozzo’s marketing vice-president immediately defended the current strategy of manufacturing a full product line. She argued that even though some products had costs in excess of their selling prices, Randazzo should consider the big picture. Many of the customers were controling costs by reducing the number of vendors from which they purchased merchandise. She argued that if Randozzo no longer produced the product for G (corvette brake components), retail chains would likely turn to Randozzo’s competitors for other products as well.

Radizzon knew that dropping products from the lien would necessitate lay-offs of some salaried and hourly employees. In the short run, lost production volume could not be made up by increases in production of other products. Over the years he had worked hard to achieve a culture of trust and cooperation within the company and community. He wondered about the options available to him.

A. What financial and nonfinancial considerations are relevant to the management team's decision to keep or drop a product line?

B. Assume $70,000 of the $600,000 in fixed costs can be saving if products C and G are dropped. What is the total benefit to the company of dropping the two products?

C. Do you agree with the marketing vice president's concern about carrying a full product line?

D. As a consultant to Randazzo, what would you recommend to:

1. Ensure each product in the line is profitable, or

2. Ensure the entire line is profitable?

Step by Step Answer:

Operations and Supply Chain Management

ISBN: 978-0078024023

14th edition

Authors: F. Robert Jacobs, Richard Chase