Question: Johnny Jones?s high school derivatives homework asks for a binomial valuation of a 12- month call option on the common stock of the Overland Railroad.

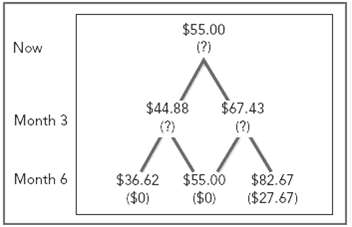

Johnny Jones?s high school derivatives homework asks for a binomial valuation of a 12- month call option on the common stock of the Overland Railroad. The stock is now selling for $45 per share and has a standard deviation of 24 percent. Johnny first constructs a binomial tree like Figure, in which stock price moves up or down every six months. Then he constructs a more realistic tree, assuming that the stock price moves up or down once every three months, or four times per year.

(a) Construct these two binomial trees.

(b) How would these trees change if Overland?s standard deviation were 30 percent?

$55.00 (?) Now $44.88 $67.43 (?) Month 3 (?) $55.00 $82.67 ($0) ($27.67) $36.62 ($0) Month 6

Step by Step Solution

3.33 Rating (162 Votes )

There are 3 Steps involved in it

a b u ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-O (23).docx

120 KBs Word File