Question: Julia Vanfleet is professor of mathematics. She has received a $225,000 inheritance from her fathers estate, and she is anxious to invest it between now

Julia Vanfleet is professor of mathematics. She has received a $225,000 inheritance from her father’s estate, and she is anxious to invest it between now and the time she retires in 12 years. Professor Vanfleet is considering two alternatives for investing her inheritance.

Alternative 1.

Corporate bonds can be purchased that mature in 12 years and that bear interest at 10%. This interest would be taxable and paid annually.

Alternative 2.

A small retail business is available for sale that can be purchased for $225,000. The following information relates to this alternative:

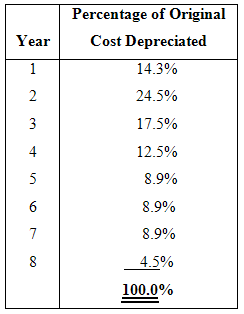

(a) Of the purchase price, $80,000 would be for fixtures and other depreciable items. The remainder would be for the company’s working capital (inventory, accounts receivable, and cash). The fixtures and other depreciable items would have a remaining useful life of at least 12 years but would be depreciated for tax reporting purposes over eight years using the following allowances published by the Internal Revenue Service:

Salvage value is not taken into account when computing depreciation for tax purposes. At any rate, at the end of 12 years these depreciable items would have a negligible Salvage value; however, the working capital would be recovered (either through sale or liquidation of the business) for reinvestment elsewhere.

(b) The store building would be leased. At the end of 12 years, if Professor Vanfleet could not find someone to buy the business, it would be necessary to pay $2,000 to the owner of the building to break the lease.

(c) Store records indicate that sales have averaged $850,000 per year and out-of-pocket costs (including wages and rent on the building) have averaged $780,000 per year (not including income taxes). Management of the store would be entrusted to employees.

(d) Professor Vanfleet’s tax rate is 40%.

Required:

Advise Professor Vanfleet as to which alternative should be selected. Use the total-cost approach to net present value in your analysis, and a discount rate of 8%. Round all dollars amounts to the nearest whole dollar.

Percentage of Original Cost Depreciated Year 14.3% 24.5% 17.5% 12.5% 5 8.9% 6. 8.9% 8.9% 4.5% 100.0% 2. 3. 4.

Step by Step Solution

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Items and Computations Years 1 Amount 2 Tax Effect 1 2 AfterTax Cash Flows 8 Factor Present Value of ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-B-D (56).docx

120 KBs Word File