Question: Reliable Waste Systems provides a solid waste collection service in a large metropolitan area. The company is considering the purchase of several new trucks to

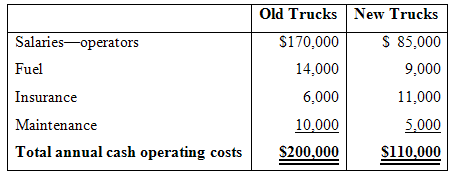

Reliable Waste Systems provides a solid waste collection service in a large metropolitan area. The company is considering the purchase of several new trucks to replace an equal number of old trucks now in use. The new trucks would cost $650,000, but they would require only one operator per truck (compared to two operators for the trucks now being used), as well as provide other cost savings. A comparison of total annual cash operating costs between the old trucks that would be replaced and the new trucks is provided below:

If the new trucks are purchased, the old trucks will be sold to a company in a nearby city for S85.000. These trucks cost $300,000 when they were new and have a current book value of S 120,000. If the new trucks are not purchased, the company will take depreciation deductions for tax purposes on the old trucks of $60,000 a year over the next two years. If the new trucks are not purchased, the old trucks will be used for seven more years and then sold for an estimated $15,000 scrap value. However, to keep the old trucks operating, extensive repairs will be needed in one year that will cost $170,000. These repairs will be expensed for tax purposes in the year incurred. The new trucks would have a useful life of seven years and would have an estimated $60,000 salvage value at the end of their useful life. The company’s tax rate is 30%, and its after-tax cost of capital is 12%. For tax purposes, the company would depreciate the equipment over five years using straight-line depreciation and assuming zero salvage value.

Required:

1. Use the total-cost approach to net present value analysis to determine whether the new trucks should be purchased. Round all dollar amounts to the nearest whole dollar.

2. Repeat the computations in (1) above, this time using the incremental-cost approach to net present value analysis.

Old Trucks New Trucks $ 85,000 Salaries-operators $170,000 Fuel 14,000 9,000 Insurance 6,000 11,000 Maintenance 5,000 10,000 Total annual cash operating costs $200,000 si10.000

Step by Step Solution

3.35 Rating (170 Votes )

There are 3 Steps involved in it

1 Items Years 1 Amount 2 Tax Effect 12 AfterTax Cash Flows 12 Factor Present Value of Cash Flows Buy the new trucks Investment in the trucks Now 65000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-B-D (55).docx

120 KBs Word File