Question: Kenisha Johnson, CEO of Eastern Electronics Inc., is looking at the possibility of marketing a new product line. Kenisha will be approaching a risk capital

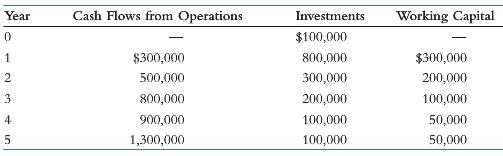

Kenisha Johnson, CEO of Eastern Electronics Inc., is looking at the possibility of marketing a new product line. Kenisha will be approaching a risk capital investor, Manon Miller, asking for $500,000 in equity participation. This is 30% of the company’s equity share. When Kenisha had her first meeting with Manon, she presented the following financial projections:

During the conversation, both agreed that 20% should be used as a discount rate to calculate the present value of the company’s cash flows and as a capitalization rate. Manon said that she hoped that at the end of five years, when she would make her exit, the company would be worth at least six times its last year’s cash flows.

1. What is the company’s net present value?

2. What is the company’s internal rate of return using only the five-year projections?

3. What is the company’s present value of the residual value?

4. What is the company’s fair market value?

5. What is Manon Miller’s internal rate of return on her investment?

Year Cash Flows from Operations Investments Wrking Capital $300,000 500,000 800,000 900,000 1,300,000 $100,000 800.000 300,000 200,000 100,000 100,000 $300,000 200,000 100,000 50.000 50,000

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

1 Year Cash Flows Investments Working Capital NCF Factors Discounted Value 0 100000 100000 000000 10... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

357-B-F-F-M (5414).docx

120 KBs Word File