Klondike Carpets Ltd. is a large Winnipeg retailer of home and office flooring. The company is a

Question:

Klondike Carpets Ltd. is a large Winnipeg retailer of home and office flooring. The company is a success because it keeps abreast of market changes and provides personalized service to its customers.

The company is owned by three brothers, each of whom plays a major role in the business operations. George, a CA, handles financing. Walter heads the buying department and travels extensively. Ken is the primary marketing person, the one who instills the concept of “personal service” in the sales organization.

Klondike’s profits for the last fiscal year amounted to $550,000 after reasonable salaries to the three managing shareholders. The company has accumulated large cash reserves.

Recently, the brothers have been discussing what to do next in their successful business. They have listened to offers to sell the company that, if accepted, would give them sufficient net capital to live a comfortable life. But they have also considered just staying the way they are (that is, a successful local business) and letting their wealth accumulate.

This sounds attractive, but they are all young enough to seriously entertain expansion possibilities. Recently, Ken completed a tour of Canada and targeted 10 cities that he thought could support a successful operation like the one in Winnipeg. The Winnipeg operation has two locations—the main store on Portage Avenue and a branch in Polo Park. The branch is managed by Shirley Friesen, who is exceptional in that she runs the business as if she owns it. In the previous year, she was rewarded with a bonus of 10% of profits.

Walter has expressed concern that Shirley, with her expertise and personality, may soon open her own store in competition. Although she does not currently have any substantial amount of capital, Walter is aware that she saves her entire bonus as well as a portion of her regular salary.

The brothers plan to meet to discuss these current issues. In preparation, George has assembled the following information:

Winnipeg branch store

Current profits …………………. | $120,000 |

Major assets: …………………. | |

Working capital and inventory …… | 300,000 |

Fixtures and leaseholds … | nominal |

Expansion stores

• New stores would be in rented premises.

• Possible good locations: 10.

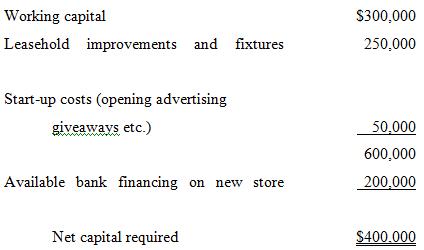

• Capital required per store:

• Profits are expected to be 30% of capital invested, or $120,000 per store (after amortization and so on).

• Klondike can raise about $2,000,000 for expansion by combining its cash reserves with a small amount of bank financing. The required bank financing is separate from the bank financing for each new store described above.

• Corporate tax rates are 15% on income subject to the small-business deduction, 25% on other business income, and 44 2⁄3% of investment income.

Required:

Recommend a course of action for:

(a) The Polo Park branch operations; and

(b) A possible expansion to the target cities.

Step by Step Answer:

Canadian Income Taxation Planning And Decision Making

ISBN: 9781259094330

17th Edition 2014-2015 Version

Authors: Joan Kitunen, William Buckwold