Laughlin Ltd. gained control of Harwood Ltd. by acquiring all its shares on January 1, 2010. The

Question:

Laughlin Ltd. gained control of Harwood Ltd. by acquiring all its shares on January 1, 2010. The equity at that date was:

Share capital ..........$100,000

Retained earnings.......... 35,000

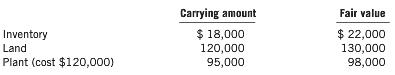

At January 1, 2010, all the identiï¬able assets and liabilities of Harwood were recorded at fair value except for:

The inventory was all sold by December 31, 2010. The plant had a further ï¬ve-year life but was sold on January 1, 2013, for $50,000. The land was sold in March 2011 for $150,000.

At January 1, 2010, Harwood had guaranteed a loan taken out by Swede Ltd. Harwood had not recorded a liability in relation to the guarantee but, as Swede was not performing well, Laughlin valued the contingent liability at $5,000. In January 2013, Swede repaid the loan. Harwood had also invented a special tool and patented the process. No asset was recorded by Harwood, but Laughlin valued the patent at $6,000, with an expected useful life of six years. The tax rate is 30%.

Financial information for these companies for the year ended December 31, 2013, is as follows:

-2.png)

Required

Prepare the consolidated ï¬nancial statements for Laughlin Ltd. as at December 31, 2013.

Step by Step Answer: