Question: Look again at Table 22.2. How does the value in 1982 of the option to invest in the Mark II change if: (a)?The investment required

Look again at Table 22.2. How does the value in 1982 of the option to invest in the Mark II change if:

(a)?The investment required for the Mark II is $800 million (vs. $900 million)?

(b)?The present value of the Mark II in 1982 is $500 million (vs. $467 million)?

(c) The standard deviation of the Mark II?s present value is only 20 percent (vs. 35 percent)?

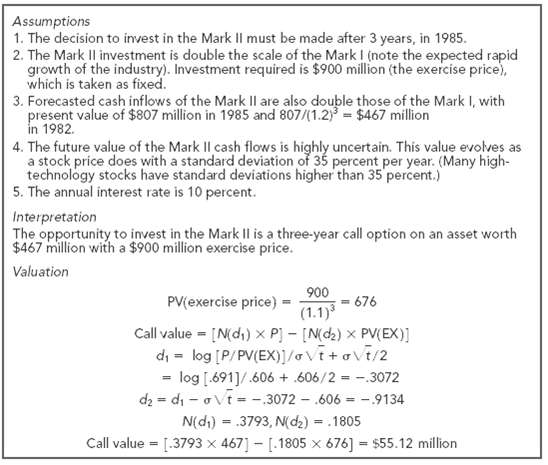

Assumptions 1. The decision to invest in the Mark Il must be made after 3 years, in 1985. 2. The Mark Il investment is double the scale of the Mark I (note the expected rapid growth of the industry). Investment required is $900 million (the exercise price), which is taken as fixed. 3. Forecasted cash inflows of the Mark Il are also double those of the Mark I, with present value of $807 million in 1985 and 807/(1.2) = $467 million in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 35 percent per year. (Many high- technology stocks have standard deviations higher than 35 percent.) 5. The annual interest rate is 10 percent. Interpretation The opportunity to invest in the Mark Il is a three-year call option on an asset worth $467 million with a $900 million exercise price. Valuation 900 PV(exercise price) = (1.1)3 Call value = [N(di) x P] - [Nd2) x PV(EX)] di - log [P/PV(EX)]/Vt+aVt/2 = log [.691]/.606 + .606/2 = -.3072 dz = di - o Vt = -3072 - .606 = - 9134 N(di) = .3793, N(d2) .1805 676 I3! Call value = [.3793 x 467] - [.1805 x 676] = $55.12 million

Step by Step Solution

3.34 Rating (166 Votes )

There are 3 Steps involved in it

a b c P 467 EX 800 035 d logPPVEXo t0t2 l... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-O (44).docx

120 KBs Word File