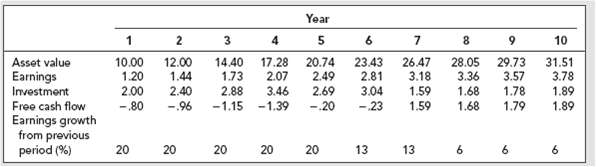

Question: Look again at Table 4.7. a. How do free cash flow and present value change if asset growth rate is only 15 percent in years

Look again at Table 4.7.

a. How do free cash flow and present value change if asset growth rate is only 15 percent in years 1 to 5? If value declines, explain why.

b. Suppose the business is a publicly traded company with one million shares outstanding. Then the company issues new stock to cover the present value of negative free cash flow for years 1 to 6. How many shares will be issued and at what price?

c. Value the company's one million existing shares by the two methods described in Section4.5.

Year 10 3. Asset value Earnings 26.47 3.18 29.73 3.57 1.78 1.79 10.00 1.20 2.00 -.80 12.00 1.44 2.40 20.74 17.28 2.07 23.43 2.81 28.05 3.36 1.68 1.68 31.51 3.78 1.89 1.89 14.40 1.73 3.46 2.69 1.59 1.59 3.04 Investment 2.88 -1.15 Free cash flow Earnings growth from previous period (%) -20 -.96 -1.39 - 23 20 20 20 20 20 13 13

Step by Step Solution

3.43 Rating (182 Votes )

There are 3 Steps involved in it

a The present value of the nearterm flows ie years 1 through 6 is 138 The present value of the horiz... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-P-V (71).docx

120 KBs Word File