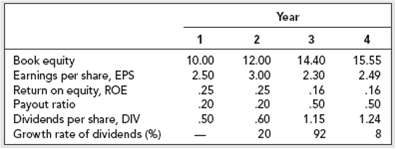

Question: Look again at the financial forecasts for Growth-Tech given in Table 4.3. This time assume you know that the opportunity cost of capital is r

Look again at the financial forecasts for Growth-Tech given in Table 4.3. This time assume you know that the opportunity cost of capital is r = .12 (discard the .099 figure calculated in the text). Assume you do not know Growth-Tech's stock value. Otherwise follow the assumptions given in the text.

a. Calculate the value of Growth-Tech stock.

b. What part of that value reflects the discounted value of P3, the price forecasted for year 3?

c.What part of P3 reflects the present value of growth opportunities (PVGO) after year 3?

d. Suppose that competition will catch up with Growth-Tech by year 4, so that it can earn only its cost of capital on any investments made in year 4 or subsequently. What is Growth-Tech stock worth now under this assumption? (Make additional assumptions ifnecessary.)

Year 1 3 Book equity Earnings per share, EPS Return on equity, ROE Payout ratio Dividends per share, DIV Growth rate of dividends (%) 10.00 2.50 25 14.40 2.30 .16 15.55 2.49 16 12.00 3.00 25 20 20 50 50 1.15 50 1.24 .60 20 92 884888

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

a GrowthTechs stock price should be b The horizon value contributes c Wit... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-P-V (68).docx

120 KBs Word File