Question: Look back at Table 20.2. Now construct a similar table for put options. In each case construct simple example to illustrate your point. 1. If

Look back at Table 20.2. Now construct a similar table for put options. In each case construct simple example to illustrate your point.

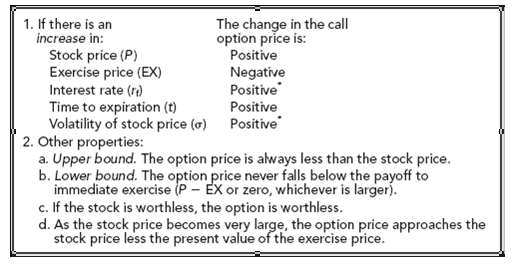

1. If there is an increase in: Stock price (P) Exercise price (EX) The change in the call option price is: Positive Negative Positive Positive Interest rate (r) Time to expiration (t) Volatility of stock price (a) Positive 2. Other properties: a. Upper bound. The option price is always less than the stock price. b. Lower bound. The option price never falls below the payoff to immediate exercise (P - EX or zero, whichever is larger). c. If the stock is worthless, the option is worthless. d. As the stock price becomes very large, the option price approaches the stock price less the present value of the exercise price.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Consider the following base case assumptions P 100 EX 100 r f 5 t 1 50 Then using the BlackSchol... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

35-B-C-F-O (25).docx

120 KBs Word File