Question: Lordsland Development Company has two competing projects: an apartment complex and an office building. Both projects have an initial investment of $720,000. The net cash

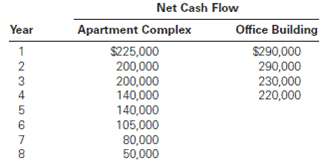

Lordsland Development Company has two competing projects: an apartment complex and an office building. Both projects have an initial investment of $720,000. The net cash flows estimated for the two projects are as follows:

The estimated residual value of the apartment complex at the end of Year 4 is $325,000. Determine which project should be favored, comparing the net present values of the two projects and assuming a minimum rate of return of 15%. Use the table of present values in thechapter.

Net Cash Flow Office Building Year Apartment Complex $225,000 200,000 200,000 140,000 140,000 105,000 80,000 50,000 $290,000 290,000 230,000 220,000 2 4 8.

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

Apartment Complex Office Building Year Present Value of 1 at 15 Net Cash Flow Pres... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

46-B-C-A-C-P-A (324).docx

120 KBs Word File