Question: Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture

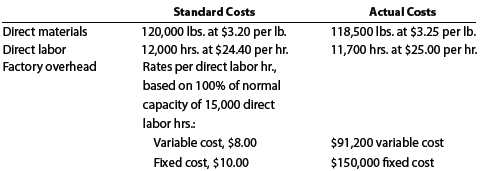

Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows:

Each unit requires 0.3 hour of direct labor.

Instructions

Determine

(A). The direct materials price variance, direct materials quantity variance, and total direct materials cost variance;

(B). The direct labor rate variance, direct labor time variance, and total direct labor cost variance; and

(C). The variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.

Standard Costs Direct materials Direct labor Factory overhead 120,000 lbs. at $3.20 per lb. 12,000 hrs. at $24.40 per hr. Rates per direct labor hr based on 100% of normal capacity of 15,000 direct Actual Costs 118,500 lbs. at $3.25 per lb. 11,700 hrs. at $25.00 per hr labor hrs: Variable cost, $8.00 $91,200 variable cost $150,000 fxed cost Fixed cost, $10.00

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

A Direct Materials Cost Variance Price variance Direct Materials Price Variance Actual Price Standar... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (2 attachments)

1204_60547fe2b841c_562142.xlsx

300 KBs Excel File

1204-B-M-A-S-C(1816).docx

120 KBs Word File