Question: Mark or Make is a bourbon distillery. Sales have been steady for the past three years and operating costs have remained unchanged. On January 1,

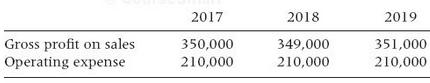

Mark or Make is a bourbon distillery. Sales have been steady for the past three years and operating costs have remained unchanged. On January 1, 2017, Mark or Make took advantage of a special deal to prepay its rent for three years at a substantial savings. The amount of the prepayment was $ 60,000. The income statement items (excluding the rent) are shown below.

Assume that the rental is deducted on the corporate tax purposes in 2017 and that there are no other temporary differences between taxable income and pre-tax accounting income. In addition, there are no permanent differences between taxable income and pretax accounting income. The corporate tax rate for all three years is 30 percent.

Required:

a. Construct income statements for 2017, 2018, and 2019 under the following approaches to interperiod income tax allocation:

i. No allocation

ii. Comprehensive allocation

b. Do you believe that no allocation distorts Mark or Make’s net income? Explain.

c. For years 2017 and 2018, Mark or Make reported net income applying the concept of comprehensive interperiod income tax allocation. During 2018, Congress passed a new tax law that will increase the corporate tax rate from 30 to 33 percent. Reconstruct the income statements for 2018 and 2019 under the following assumptions:

i. Mark or Make uses the deferred method to account for interperiod income tax allocation.

ii. Mark or Make uses the asset– liability approach to account for interperiod income tax allocation.

d. Which of the two approaches used in question (a) provides measures of income and liabilities that are useful to decision makers? Explain.

2017 2018 2019 Gross profit on sales Operating expense 350,000 210,000 349,000 210,000 351,000 210,000

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

a i 2017 2018 2019 Gross Profit on Sales 350000 349000 351000 Operating Expenses 210000 210000 210000 Rent Expense 60000 0 0 Taxable Income 80000 139000 141000 Tax rate x30 x30 x30 Taxes paid 24000 41... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

371-B-A-G-F-A (5006).docx

120 KBs Word File