Microlmage Technology, Inc. produces miniature digital color cameras that can be attached to endoscopes and other medical

Question:

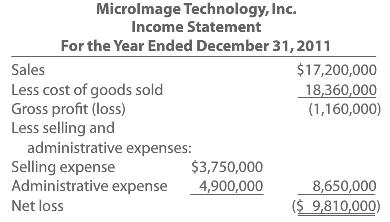

Microlmage Technology, Inc. produces miniature digital color cameras that can be attached to endoscopes and other medical devices. The cameras sell for $215 per unit and are disposed of after each use. For 2011, the company’s first full year of operation, the company had sales of 80,000 units and a net loss of $9,810,000, as follows:

The company is closely held, with six major inventors. Early in the first quarter of 2012, Warren Logan, company CFO, was preparing to meet with them to present profitability estimates for the coming two years. He expected the meeting to be somewhat hostile. Two days before, he had received an email from one of the investors, Sanjay Patel:

Required

a. Recast the full costing income statement for 2011 into a variable costing format. Does it appear, as Sanjay Patel contends, that the more the company sells, the more it loses?

b. Based on the previous information, calculate sales in dollars and units needed to break even in 2012.

c. Warren Logan, CFO, has developed assumptions that he believes are reasonable for 2012 and 2013. Using these assumptions, prepare budgeted income statements for 2012 and 2013 using the variable costing method. Are the major investors likely to find forecasted profits encouraging?

Assumptions for 2012

1. The company will hire two additional sales managers at a base salary of $90,000 each.

2. R&D will be cut by $1,100,000.

3. Unit sales will increase by 30 percent.

Assumptions for 2013

1. The company will hire one additional sales manager at a base salary of $90,000.

2. R&D will be increased by $600,000 over 2012.

3. Unit sales will increase by 60 percent over 2012.

Step by Step Answer: