Question: Miller Companys most recent contribution format income statement is shown below: Required: Prepare a new contribution format income statement under each of the following conditions

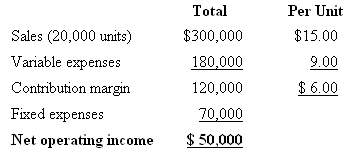

Miller Company’s most recent contribution format income statement is shown below:

Required:

Prepare a new contribution format income statement under each of the following conditions (consider each case independently):

1. The number of units sold increases by 15%.

2. The selling price decreases by $1.50 per unit, and the number of units sold increases by 25%.

3. The selling price increases by $1.50 per unit, fixed expenses increase by $20,000, and the number of units sold decreases by 5%.

4. The selling price increases by 12%, variable expenses increase by 60 cents per unit, and the number of units sold decreases by 10%.

Per Unit Total Sales (20,000 units) $300,000 $15.00 Variable expenses 180,000 9.00 Contribution margin $ 6.00 120,000 Fixed expenses 70,000 $ 50,000 Net operating income

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Total Per Unit 1 Sales 20000 units 115 23000 units 345000 1500 Var... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

25-B-M-A-C-V-P (16).docx

120 KBs Word File