Question: A more detailed examination of the situation in Problem 8-2 reveals that there are two additional mutually exclusive alternatives to be considered. Both cost more

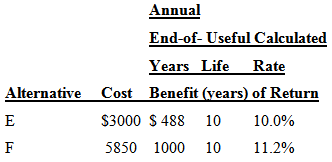

A more detailed examination of the situation in Problem 8-2 reveals that there are two additional mutually exclusive alternatives to be considered. Both cost more than the $1300 for the four original alternatives.

IT the MARR remains at 8%, which one of the six alternatives should be selected? Neither Alt. E nor F has any end-of-useful-life salvage value.

Annual End-of- Useful Calculated Years Life Rate Alternative Cost Benefit (vears) of Return $3000 $ 488 10 10.0% 5850 1000 10 11.2%

Step by Step Solution

3.25 Rating (171 Votes )

There are 3 Steps involved in it

4000 3000 2000 1000 100... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

7-B-E-M (181).docx

120 KBs Word File