Question: Multinational transfer pricing, global tax minimization. Industrial Diamonds, Inc., based in Los Angeles, has two divisions: South African Mining Division, which mines a rich diamond

Multinational transfer pricing, global tax minimization. Industrial Diamonds, Inc., based in Los Angeles, has two divisions:

- South African Mining Division, which mines a rich diamond vein in South Africa

- U.S Processing Division, which polishes raw diamonds for use in industrial cutting tools

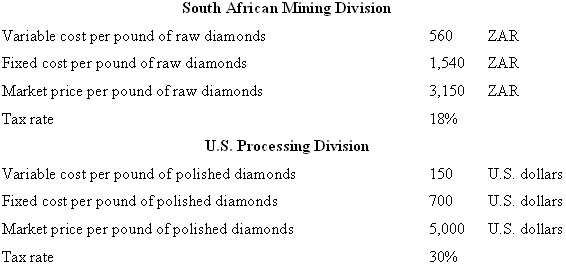

The Processing Division’s yield is 50%: It takes 2 pounds of raw diamonds to produce 1 pound of top-quality polished industrial diamonds. Although all of the Mining Division’s output of 4,000 pounds of raw diamonds is sent for processing in the United States, there is also an active market for raw diamonds in South Africa. The foreign exchange rate is 7 ZAR (South African Rand) = $1 U.S. The following information is known about the two divisions:

1. Compute the annual pre-tax operating income, in U.S. dollars, of each division under the following transfer-pricing methods: (a) 200% of full cost and (b( market price.

2. Compute the after-tax operating income, in U.S. dollars, for each division under the transfer-pricing methods in requirement 1. (Income taxes are not included in the computation of cost-based transfer price, and Industrial Diamonds does not pay U.S. income tax on income already taxed in South Africa.)

3. If the two division managers are compensated based on after-tax division operating income, which transfer-pricing method will each prefer? Which transfer-pricing method will maximize the total after- tax operating income of Industrial Diamonds?

4. In addition to tax minimization, what other factors might Industrial Diamonds consider in choosing a transfer-pricing method?

South African Mining Division Variable cost per pound of raw diamonds 560 ZAR Fixed cost per pound of raw diamonds 1,540 ZAR Market price per pound of raw diamonds 3,150 ZAR Tax rate 18% U.S. Processing Division U.S. dollars Variable cost per pound of polished diamonds 150 U.S. dollars Fixed cost per pound of polished diamonds 700 Market price per pound of polished diamonds 5,000 U.S. dollars Tax rate 30%

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Multinational transfer pricing global tax minimization This is a twocountry twodivision transferpricing problem with two alternative transferpricing m... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

24-B-C-A-M-C-M-I (47).docx

120 KBs Word File