Question: Multiple Choice Questions 1. Oceanview Software began January with $3,200 of merchandise inventory. During January, Oceanview made the following entries for its inventory transactions: How

Multiple Choice Questions

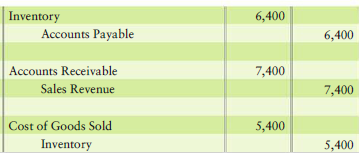

1. Oceanview Software began January with $3,200 of merchandise inventory. During January, Oceanview made the following entries for its inventory transactions:

How much was Oceanviews inventory at the end of January?

a. $5,200

b. Zero

c. $4,200

d. $4,700

2. What is Oceanviews gross profit for January?

a. Zero

b. $7,400

c. $5,400

d. $2,000

3. When does the cost of inventory become an expense?

a. When inventory is purchased from the supplier.

b. When cash is collected from the customer.

c. When payment is made to the supplier.

d. When inventory is delivered to a customer.

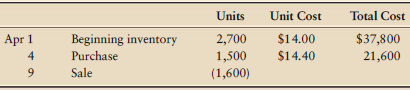

The next two questions use the following facts. Perfect Corner Frame Shop wants to know the effect of different inventory costing methods on its financial statements. Inventory and purchases data for April follow:

4. If Perfect Corner uses the FIFO method, the cost of the ending inventory will be

a. $37,000.

b. $22,700.

c. $22,400.

d. $21,600.

5. If Perfect Corner uses the LIFO method, cost of goods sold will be

a. $22,700.

b. $23,000.

c. $22,400.

d. $21,600.

6. In a period of rising prices,

a. Net income under LIFO will be higher than under FIFO.

b. Gross profit under FIFO will be higher than under LIFO.

c. LIFO inventory will be greater than FIFO inventory.

d. Cost of goods sold under LIFO will be less than under FIFO.

Inventory Accounts Payable 6,400 6,400 Accounts Receivable 7,400 Sales Revenue 7,400 Cost of Goods Sold 5,400 Inventory 5,400

Step by Step Solution

3.41 Rating (170 Votes )

There are 3 Steps involved in it

1 c 3200 6400 5400 4200 2 d 7400 5400 2000 3 d ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

196-B-M-A-I (1537).docx

120 KBs Word File