Question: Multiple Choice Questions 1. What is the best source of income for a corporation? a. Discontinued operations b. Continuing operations c. Extraordinary items d. Prior-period

Multiple Choice Questions

1. What is the best source of income for a corporation?

a. Discontinued operations

b. Continuing operations

c. Extraordinary items

d. Prior-period adjustments

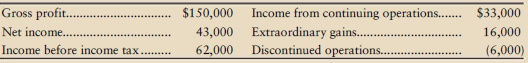

Michaels Lotion Company reports several earnings numbers on its current-year income statement (parentheses indicate a loss):

2. How much net income would most investment analysts predict for Michaels to earn next year?

a. $43,000

b. $16,000

c. $33,000

d. $49,000

3. Return to the preceding question. Suppose you are evaluating Michaels Lotion Company stock as an investment. You require an 8% rate of return on investments, so you capitalize Michael’s earnings at 8%. How much are you willing to pay for all of Michael’s stock?

a. $1,875,000

b. $412,500

c. $537,500

d. $775,000

4. Superior Value Corporation had the following items that were labeled extraordinary on its income statement:

Extraordinary flood loss.........................$100,000

Extraordinary gain on lawsuit................ 150,000

Net income from operations, before income tax and before these extraordinary items, totals $240,000, and the income tax rate is 30%. Superior Values bottom line net income after tax is

a. $273,000.

b. $203,000.

c. $290,000.

d. $168,000.

5. Superior Value Corporation in question 36 has 9,000 shares of 7%, $100 par preferred stock, and 200,000 shares of common stock outstanding. Earnings per share for net income is

a. $0.58.

b. $1.20.

c. $1.51.

d. $0.70.

6. Earnings per share is not reported for

a. Extraordinary items.

b. Discontinued operations.

c. Continuing operations.

d. Comprehensive income.

. Gross profit Net income.. $150,000 43,000 Extraordinary gains. 62,000 Discontinued operations. Income from continuing operations... $33,000 16,000 Income before income tax....... (6,000)

Step by Step Solution

3.43 Rating (166 Votes )

There are 3 Steps involved in it

1 b Continuing operations 2 c 33000 3 b 3300... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

196-B-A-I-S (856).docx

120 KBs Word File