Multiple Choice Questions 1. Which of the following accounts would not be included in the closing entries?

Question:

Multiple Choice Questions

1. Which of the following accounts would not be included in the closing entries?

a. Depreciation Expense

b. Accumulated Depreciation

c. Retained Earnings

d. Service Revenue

2. A major purpose of preparing closing entries is to

a. Zero out the liability accounts.

b. Close out the Supplies account.

c. Adjust the asset accounts to their correct current balances.

d. Update the Retained Earnings account.

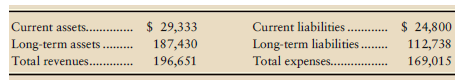

3. Selected data for the Blossom Company follow:

Based on these facts, what are Blossoms current ratio and debt ratio?

Current ratio Debt ratio

a. 1.633 to 1 0.742 to 1

b. 0.694 to 1 6.815 to 1

c. 1.183 to 1 0.635 to 1

d. 1.633 to 1 0.601 to 1

4. Unadjusted net income equals $7,500. Calculate what net income will be after the following adjustments:

1. Salaries payable to employees, $660

2. Interest due on note payable at the bank, $100

3. Unearned revenue that has been earned, $950

4. Supplies used, $300

5. Salary Payable at the beginning of the month totals $28,000. During the month salaries of $126,000 were accrued as expense. If ending Salary Payable is $15,000, what amount of cash did the company pay for salaries during the month?

a. $124,000

b. $139,000

c. $126,000

d. $154,000

Step by Step Answer:

Financial accounting

ISBN: 978-0136108863

8th Edition

Authors: Walter T. Harrison, Charles T. Horngren, William Bill Thomas