Question: MVP Corp uses LIFO to value its inventory. The 2014 inventory records disclose the following: At December 26, 2014, the company had a special, nonrecurring

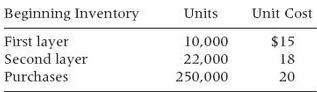

MVP Corp uses LIFO to value its inventory. The 2014 inventory records disclose the following:

At December 26, 2014, the company had a special, nonrecurring opportunity to purchase 40,000 units at $ 17 per unit. The purchase can be made and the units delivered on December 30, or it can be delayed until the first week of January 2015. The company plans to make the purchase, owing to the obvious cost savings involved. Sales for 2014 totaled 245,000 units.

Team Debate:

Team 1: Describe the financial statement effects of making the purchase in 2014 as opposed to 2015. Argue for making the purchase during 2014. Defend the use of LIFO. Use the matching concept in your defense.

Team 2: Given the financial statement effects of the decision to purchase in 2014, argue against the use of LIFO and in favor of FIFO. Base your arguments on the conceptual framework— for example, representational faithfulness and neutrality. Use the matching concept in your argument.

Beginning Inventory Uts nit Cost First layer Second layer Purchases 10,000 22,000 250,000 S15 18 20

Step by Step Solution

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Team 1 Defend LIFO Cost of goods sold if the purchase is postponed until 2015 Beginning Inventory First Layer 10000 x 15 150000 Second Layer 22000 x 18 396000 Purchases 250000 x 20 5000000 Available 2... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

371-B-A-G-F-A (4955).docx

120 KBs Word File