Question: Ogleby Company estimates that 240,000 direct labor hours will be worked during 2010 in the Assembly Department. On this basis, the following budgeted manufacturing overhead

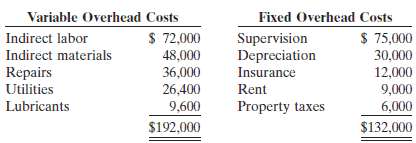

Ogleby Company estimates that 240,000 direct labor hours will be worked during 2010 in the Assembly Department. On this basis, the following budgeted manufacturing overhead data are computed.

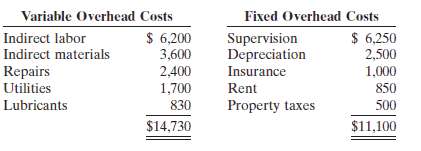

It is estimated that direct labor hours worked each month will range from 18,000 to 24,000 hours. During January, 20,000 direct labor hours were worked and the following overhead costs were incurred.

Instructions(a) Prepare a monthly manufacturing overhead flexible budget for each increment of 2,000 direct labor hours over the relevant range for the year ending December 31, 2010.(b) Prepare a manufacturing overhead budget report for January.(c) Comment on management's efficiency in controlling manufacturing overhead costs inJanuary.

Variable Overhead Costs Indirect labor Indirect materials Repairs Utilities Lubricants Fixed Overhead Costs Supervision Depreciation $ 75,000 $ 72,000 30,000 Insurance Rent Property taxes 26,400 9,600 9,000 6,000 $132,000 $192,000

Step by Step Solution

3.40 Rating (184 Votes )

There are 3 Steps involved in it

a OGLEBY COMPANY Monthly Manufacturing Overhead Flexible Budget Assembly Department For the Year 201... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

47-B-M-A-B-P-C (124).docx

120 KBs Word File